Petroleum News sources close to the action say that the local Alaska Oil Search (now Santos) office is fully staffed and continuing to work on its North Slope operations. In her part of the presentation Santos’ new chief financial officer, Anthea McKinnell, said the company’s “balance sheet is ready to fund growth” and that the needed $400 million to fund 2022 capex for Pikka and Dorado could be added at an average $65 per barrel oil price. 15 said the two projects would be “FID-ready” by mid-year. Santos had previously said it expected to make a final investment decision, or FID, on its Pikka project in Alaska in the first half of 2022 and on its Dorado project off Western Australia by mid-2022, but on Feb.

PIKKA ISSUE FREE

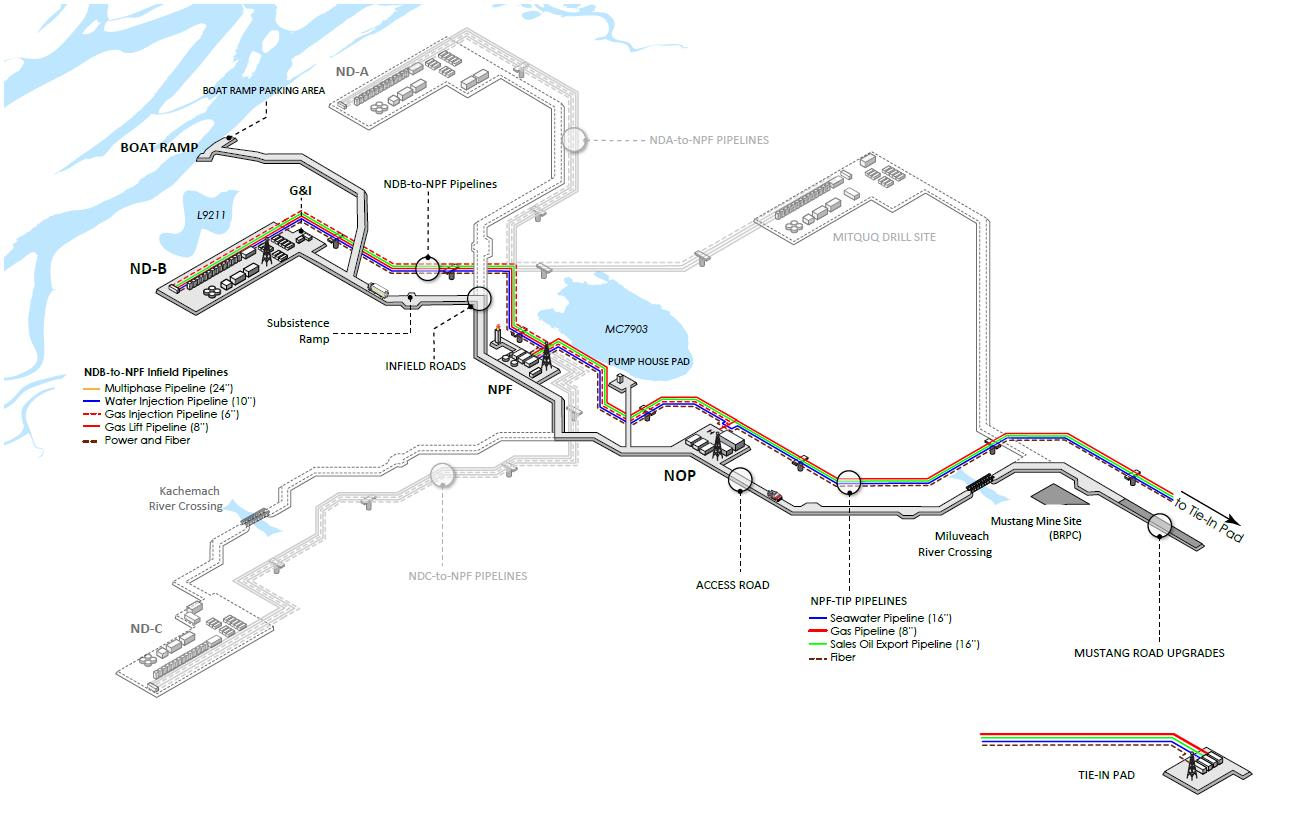

Guidance assumes “an average oil price of approximately US$65 per barrel in 2022” would generate sufficient free cash flow to fund forecast major growth projects capital expenditure, likely including the contingent amount” for Pikka and Dorado. A contingent amount of up to approximately US$400 million could be added should the Dorado and Pikka oil projects take final investment decisions in 2022. In its mid-February presentation, Santos’ guidance for 2022 said major growth projects capital expenditure was expected to be in the range of US$1.15 billion to US$1.3 billion. But those numbers are for the Pikka unit only and not the recent discoveries close to it that could be brought online with Pikka. Independently verified 2C gross reserves for Pikka 1 are 413 million barrels with total Pikka 2C gross resource at 768 million barrels, and the material resource at 968 million barrels. Technically still on its permitting schedule to come online in 2025 at a breakeven price of less than $40 a barrel, a target development IRR of less than 20%, the first phase of the Pikka project is designed to deliver 80,000 barrels of oil per day. Since the merger of Oil Search and Santos in December, some uncertainty has surrounded the future timing of Pikka development, as buyouts often slow project developments.Īmong the prospective oil projects today, Oil Search’s Pikka Phase 1 development on Alaska’s North Slope is in the top 25% for the lowest GHG intensity, per Wood Mackenzie’s emissions benchmarking tool. Pikka was championed by one of Alaska’s most successful oil entrepreneurs, Bill Armstrong, who brought Oil Search Ltd. Santos Ltd.’s recent presentation of its successful 2021 results and a brief 2022 guidance led to a number of articles bemoaning the future of the Alaska North Slope Pikka project.

Pikka project appears on track for 2025 first oil, Alaska office intact Providing coverage of Alaska and northern Canada's oil and gas industry

PIKKA ISSUE ARCHIVE

Phase 1 of Pikka is an estimated US$2.6 billion investment, with 2,600 jobs during construction and 500 during production of 80,000 barrels per day.Ī 2019 Clean Water Act permit allows for three drill sites for production and injection wells, a central processing facility, an operations center with a 200-bed camp, approximately 25 miles of roads, two bridges, and approximately 35 miles of pipelines.SEARCH our ARCHIVE of over 14,000 articles “The project will add further diversification to our portfolio and reduces geographic concentration risk,” says Santos Managing Director and CEO Kevin Gallagher. In between the two forecasts, Santos acquired Oil Search, including its Alaska headquarters in the former BP building in Midtown Anchorage. At the same time, Repsol anticipated first oil from Pikka in 2026, a delay from the 2025 forecast a year earlier when the majority partner was Papua New Guinea-based Oil Search.

The decision had been expected this month after Spanish oil company Repsol, the 49 percent partner in Pikka, alerted investors in a second-quarter earnings call.

0 kommentar(er)

0 kommentar(er)